Behavioral Economics by Richard Thaler

Behavioral economics is the study of how people make economic decisions and how those decisions affect the economy. It is a relatively new field that combines economics with psychology to understand why people sometimes make irrational decisions. Behavioral economists have found that people are often swayed by emotions, social pressure, and other factors when making economic choices.

This research can help policy makers design better policies and businesses create products that better meet customer needs.

Behavioral economics is the study of how people actually make economic decisions, as opposed to the traditional view of how they should make those decisions. It takes into account things like emotion, intuition, and social context when it comes to making financial choices.

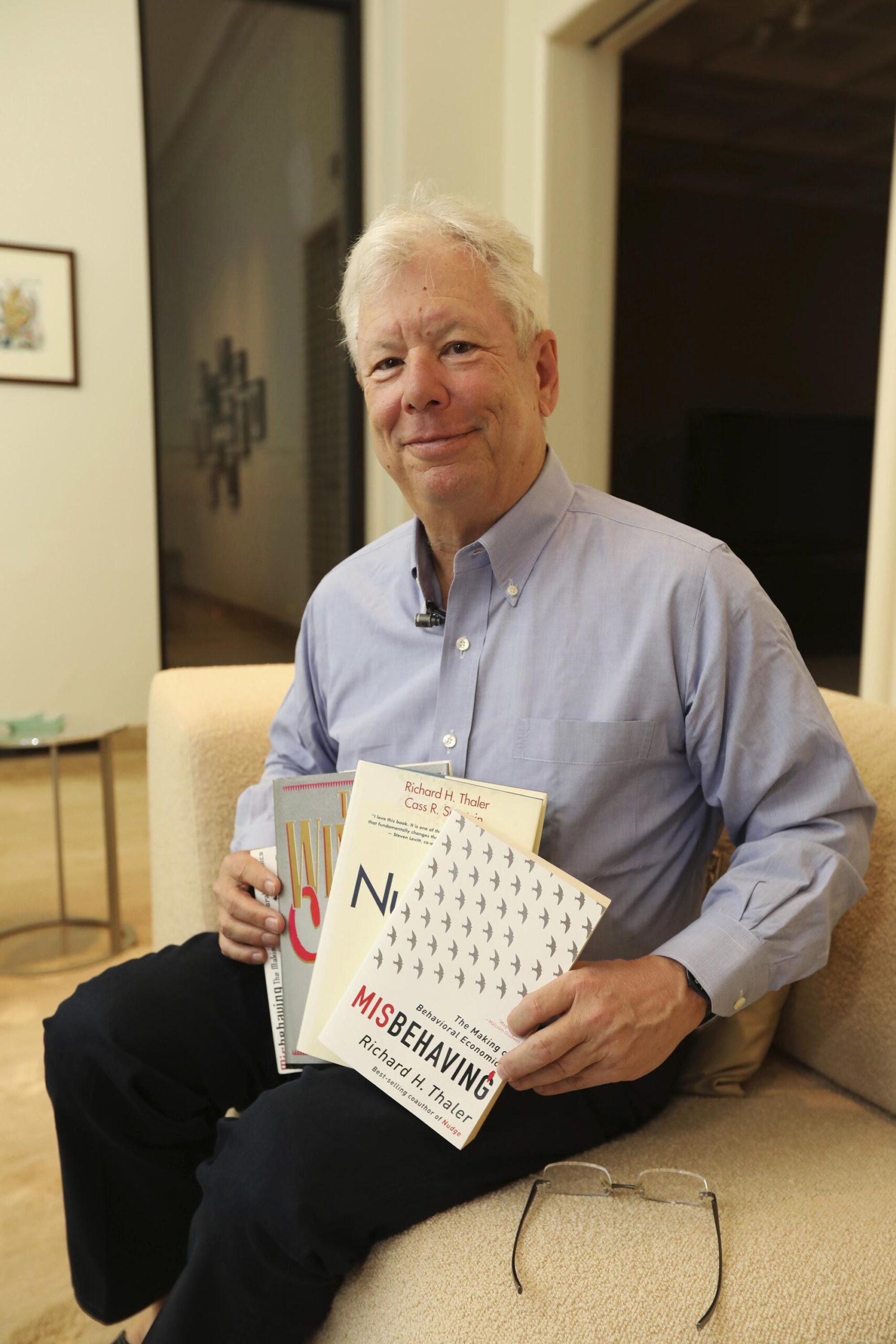

Richard Thaler is one of the leading figures in behavioral economics.

In his book Nudge, he outlines some of the ways that we can use this knowledge to improve public policy and make people’s lives better. For example, he argues that we should take into account people’s natural tendencies towards procrastination when designing retirement savings plans. By making it easy for people to save money automatically, we can help them overcome their own laziness and ensure a comfortable retirement.

Thaler’s work has had a major impact on public policy around the world. His ideas have been used to design everything from pension plans to healthcare policies. And as our understanding of human behavior continues to improve, there’s no doubt that behavioral economics will continue to shape the way we think about economic decision-making.

Credit: thedaily.case.edu

What are the Main Ideas of Behavioural Economics?

Behavioural economics is a relatively new field that combines psychology and economics to try to understand why people make the economic decisions they do. It has found that people are often irrational in their decision-making, and don’t always act in their own best interests.

Some of the main ideas of behavioural economics include:

1. People are often irrational in their decision-making.

2. People don’t always act in their own best interests.

3. Emotions can play a big role in economic decisions.

4. Social norms can influence economic behaviour.

5. Economic decisions are often made based on limited information or knowledge.

What is Thaler’S Nudge Theory?

Thaler’s Nudge Theory, also known as the libertarian paternalism theory, posits that individuals can be nudged towards making certain decisions that will ultimately benefit them without infringing on their freedom to choose. The theory has been used to explain a wide range of phenomena, from why people might save more money if their employer automatically enrolls them in a 401k plan, to why it is difficult to quit smoking.

The key idea behind nudge theory is that humans are not always rational decision-makers.

We are often influenced by our emotions, our biases, and our past experiences. As a result, we don’t always make the best choices for ourselves – even when those choices seem obvious in retrospect.

Nudge theory attempts to account for this by providing gentle “nudges” that guide people towards better decisions without taking away their freedom to choose.

For example, employers might automatically enroll new employees in a 401k plan with a low default contribution rate. This nudges employees towards saving for retirement without forcing them to do so.

Critics of nudge theory argue that it relies on an overly simplistic view of human behavior.

They also worry that nudges could be used to manipulate people into making choices that they would not otherwise make – such as voting for a particular candidate or buying a particular product.

What Does Richard Thaler Believe In?

Richard Thaler is an American economist and the Ralph and Dorothy Keller Distinguished Service Professor of Behavioral Science and Economics at the University of Chicago Booth School of Business. He is a central figure in the development of behavioral economics and has contributed to the founding of the field of nudging, which uses insights from behavioral science to try to influence people’s choices in order to improve their welfare. In 2017, he was awarded the Nobel Prize in Economics for his contributions to behavioral economics.

Thaler’s research focuses on understanding how people make economic decisions that do not conform to traditional models such as expected utility theory. In particular, he has studied how mental shortcuts (heuristics) can lead people to make suboptimal decisions, how emotions affect decision-making, and how social preferences like fairness or reciprocity can impact economic outcomes. His work often takes an interdisciplinary approach, integrating insights from psychology and other social sciences into economics.

One of Thaler’s most influential ideas is that humans are “mental misers” who attempt to conserve cognitive effort by using simple rules of thumb (heuristics) rather than engaging in more complex deliberative reasoning. This often leads them to make suboptimal decisions, as they fail to take into account all relevant information or weight it properly. Another key idea is that humans display “bounded rationality”, meaning that their decision-making is limited by their cognitive abilities as well as time and information constraints.

As a result, they are often irrational in ways that can be predicted by psychological theories such as prospect theory or loss aversion. Finally, Thaler argues that standard economic models which assume rational agents are often misspecified because they ignore these important aspects of human behavior.

In recent years, Thaler has applied his ideas about bounded rationality and mental misers to the policy domain through the concept of “nudging”.

The basic idea behind nudging is that small changes in environmental cues (such as default options or framing effects) can have large impacts on people’s choices without restricting their freedom or requiring them to change their preferences. Nudging has been implemented in a variety of domains including retirement saving, organ donation rates, energy conservation, and healthy eating initiatives.

What is Behavioural Economics Theory?

Behavioural economics is a field of economics that studies the behaviour of individuals and groups in relation to economic decisions and outcomes. It intersects with other disciplines such as psychology, sociology, anthropology and neuroscience.

The key concepts in behavioural economics include:

• bounded rationality – the idea that people are not always rational in their decision-making;

• cognitive biases – judgments that deviate from what would be considered objectively rational;

+ framing effects – how people’s choices are affected by how information is presented to them; Heuristics- rules of thumb that people use to make decisions; loss aversion- the tendency for people to prefer avoiding losses over acquiring equivalent gains.

Behavioural economics has been used to explain a wide range of real-world phenomena, including why: People save too little for retirement; they are overweight and unhealthy; they procrastinate on important tasks; they smoke despite knowing it is bad for their health.

The insights from behavioural economics can be used to design policies that nudge people towards making better decisions for themselves and society as a whole.

ECONOMICS – Behavioural Economics – Richard Thaler

7 Principles of Behavioural Economics

Behavioural economics is a relatively new field of study that combines economic theory with insights from psychology to better understand human behaviour. While traditional economics assumes that people are rational and make decisions based on self-interest, behavioural economics recognises that humans are often irrational and our decisions are influenced by a number of factors, including emotions, social norms and cognitive biases.

There are seven principles of behavioural economics that can help us to better understand how people make decisions and why they sometimes make choices that defy economic logic:

1. People are not always rational – Traditional economic theory assumes that people are rational beings who make logical, well-thought-out decisions based on their own self-interest. However, behavioural economists recognise that humans are often irrational creatures who don’t always act in our own best interests. We may be influenced by our emotions or past experiences, or we may simply not have the time or capacity to process all the information available to us before making a decision.

This means that people don’t always behave in the way traditional economic models predict they will.

2. People care about more than just money – In traditional economic models, people are assumed to be motivated purely by financial gain. However, behavioural economists recognise that people care about more than just money; we also value things like social status, relationships and fairness.

This means that we often place a higher value on goods or services that provide non-financial benefits (such as prestige or happiness) than those which simply offer monetary rewards.

3. People are influenced by their peers – Social norms play a big role in shaping human behaviour; we often follow the lead of those around us when it comes to making decisions (even if those decisions might not be in our own best interests). For example, if everyone else is buying something, we may feel pressure to do so as well even if we can’t really afford it; conversely, if no one else is buying something then we may be less likely to do so even if it would be beneficial for us to do so (such as investing in an energy-efficient appliance).

Recognising how peer pressure can influence our behaviour can help us to make better choices for ourselves.

4. People procrastinate – One common feature of human behaviour is procrastination; putting off until tomorrow what could be done today (or even later today!).

Conclusion

Behavioral economics is the study of how people make economic decisions. It is a relatively new field that combines psychology and economics.

Behavioral economists believe that people are not always rational when it comes to making economic decisions.

They take into account factors such as emotions, cognitive biases, and social norms when making decisions.

Behavioral economics has been used to explain a wide range of phenomena, including why people save too little for retirement, why they are reluctant to sell assets at a loss, and why they over-value items that they own.

The field of behavioral economics is still evolving and there is much more research to be done in this area.

However, it has already had a significant impact on our understanding of how people make economic decisions.