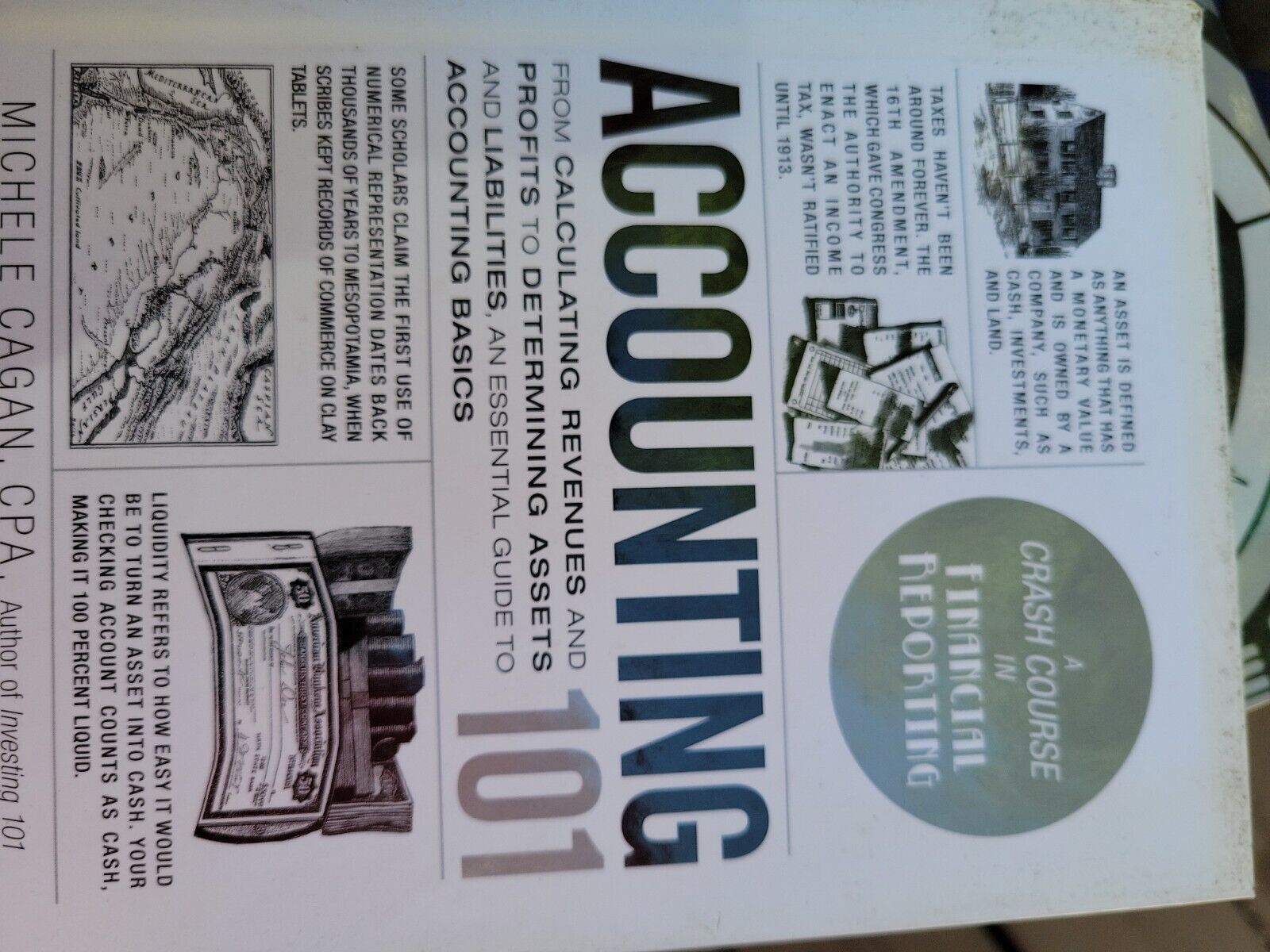

Acc 101 by Michele Cagan

Michele Cagan’s “Acc 101” is a well-organized and informative introduction to accounting. The book covers the basic concepts of financial accounting, including double-entry bookkeeping, accruals and deferrals, and financial statements. It also includes a brief history of accounting and an overview of current accounting practices.

Cagan does an excellent job of explaining the material in a clear and concise manner, making it easy for readers to understand the concepts. The book also includes numerous examples and practice problems to help readers master the material. Overall, Acc 101 is an excellent resource for anyone looking for a solid introduction to accounting principles.

Michele Cagan’s ACC 101 is a great resource for anyone looking to learn more about accounting. The book covers the basics of financial accounting, including how to read and prepare financial statements, and also provides an overview of managerial accounting. Whether you’re a student or a business professional, ACC 101 is a must-read if you want to gain a better understanding of this important topic.

Accounting 101 Book Pdf

When it comes to money management, there is a lot to learn. And, if you’re like most people, you probably don’t have the time or patience to sit down and read a textbook on the subject. That’s where Accounting 101 can help.

This book is written in plain English and provides step-by-step instructions on everything from creating a budget to tracking your investments.

There’s no need to be intimidated by accounting. With this book as your guide, you’ll quickly master the basics and be on your way to financial success!

Credit: www.amazon.com

What is Accrual Basis Accounting

Accrual basis accounting is an accounting method that recognizes revenue and expenses when they are earned or incurred, regardless of when the cash is received or paid. This approach provides a more accurate picture of a company’s financial position than cash basis accounting, which only records transactions when cash changes hands.

The accrual basis of accounting is generally used by businesses and other organizations.

Under this method, revenues and expenses are recognized as soon as they are earned or incurred, regardless of when the money is actually received or paid. For example, if a company sells goods on credit, the sale is recorded immediately as revenue, even though the customer has not yet paid for the merchandise. In contrast, under the cash basis of accounting, revenues and expenses would be recorded only when cash changes hands.

There are several advantages to using accrual basis accounting. First, it provides a more accurate picture of a company’s financial position since all revenues and expenses are recognized in the period in which they occur. Second, it makes forecasting future results easier since trends can be more easily spotted.

Finally, it facilitates comparisons with other companies since most businesses use accrual basis accounting.

Despite these advantages, there are also some disadvantages to using accrual basis accounting. One disadvantage is that it can be more difficult to track specific transactions since they may span multiple periods.

Another potential disadvantage is that it may result in delayed recognition of income taxes payable since taxes are not typically due until after the end of the year in which they were incurred.

What are the Benefits of Accrual Basis Accounting

The accrual basis of accounting is an accounting method that records economic events regardless of when cash is exchanged. The accrual basis allows businesses to match revenues with the expenses incurred in earning them, which provides a more accurate picture of a company’s financial position. It also provides information about future cash needs.

The main benefit of accrual basis accounting is that it provides a more accurate portrayal of a company’s financial position and future cash needs.

How Does Accrual Basis Accounting Differ from Cash Basis Accounting

The most significant difference between accrual basis accounting and cash basis accounting is the timing of when revenue and expenses are recorded. Under accrual basis accounting, revenue is recognized when it is earned, regardless of when the payment is received. Expenses are recognized when they are incurred, regardless of when they are paid.

In contrast, under cash basis accounting, revenue is only recognized when it is actually received in the form of cash (or its equivalent). Similarly, expenses are only recognized when they are actually paid out in cash.

There are a few key implications of this difference in timing.

First, accrual basis accounting provides a more accurate picture of a company’s financial performance since it better reflects the true economic activity that has taken place. This can be particularly important for businesses with long sales cycles or who often extend credit to customers. Second, accrual basis accounting generally results in more even income recognition over time, which can make budgeting and forecasting easier.

Finally, because accrual basis accounting requires businesses to track receivables and payables more closely, it typically results in better internal controls and less risk of fraud or error.

Real Estate Investing 101 & Budgeting 101 by Michele Cagan – Book Review

Conclusion

Michele Cagan’s blog post “Acc 101” discusses the basics of accounting. She starts by explaining the three types of financial statements – the balance sheet, income statement, and cash flow statement. She then goes into detail about how each type of statement works.

Cagan finishes her post with a brief overview of double-entry bookkeeping.